About U.S. Income Taxes

March 1, 2022

Nearly everyone living in the United States has to pay a certain amount of their income to the federal, state, and local governments every year in the form of tax. Nurses employed by American healthcare facilities through direct-hire must file U.S. Income taxes. Here, our nurse recruitment agency explains what's involved.

How Much Tax Will I Pay?

Taxation in the US operates under tax brackets — thresholds that tell you what percentage of your income you must pay. The higher your income, the higher the tax bracket. As a result, you will need to pay a higher percentage of your income. For example, you can expect to pay anywhere between 10% and 37% of your income to the federal government depending on your yearly income level.

The Role of Your Employer in Tax Collection

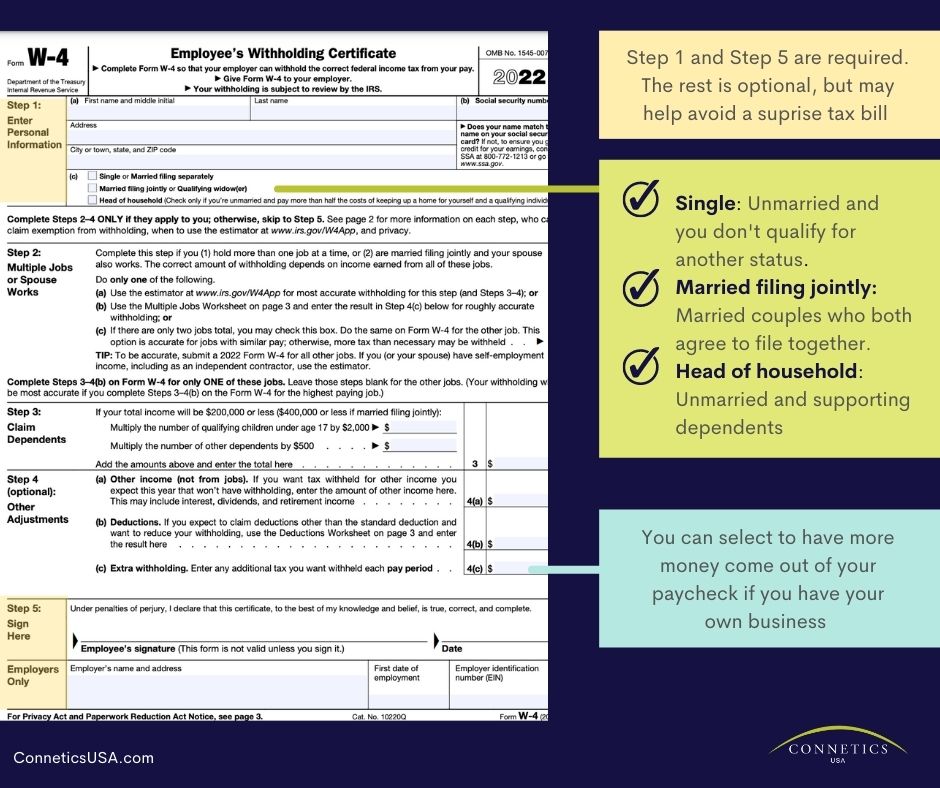

Federal taxes are collected by the Internal Revenue Service (IRS), while state taxes are collected by individual state governments. To make paying your taxes easier, and to ensure you don’t have to pay what is usually a large amount of money at one time, your employer will keep a portion of your salary from each paycheck that will go towards your state and federal taxes. The amount they keep is called a "withholding." In addition to federal, state, and local income tax withholdings, you will notice that your employer will also withhold a portion of your paycheck for Social Security and Medicare taxes. These mandatory withholdings are not available to be refunded after you file your taxes. The amount your employer withholds from your paycheck depends on the information you provide on your W-4.

What is a W-4 Tax Form?

The W-4 is a form your employer will send you before you begin working. This form will help your employer determine how much money they will withhold from each paycheck. If you’re unsure about how to answer the questions on the form, be sure to ask your human resources representative. A good rule of thumb on the side of having too much withheld. This is because at the end of the year, any overpayments will be returned to you in the form of a tax refund. However, if you paid too little, you could end up owning quite a bit of money. In fact, many people choose to claim zero deductions on their W-4, have the maximum amount withheld from each check, and enjoy a bigger refund when they file their taxes at the end of the year.

How Do I File My Taxes?

While your employer will make regular payments to the IRS for you, it’s still your responsibility to file a federal and state tax return each year. To file your taxes, you will need:

- Your form W-2, which will be sent to you by your employer. It shows how much money you earned in the year. It also lets you know how much federal, state, and other taxes your employer already paid for you. The law requires companies to send out the W-2 by January 31st. If you do not receive your W-2 within two weeks, call your employer and ask for it

- Your filing status. This is mostly determined by whether you’re married, but the percentage you pay toward household expenses also affects it

- Your tax filing form. To file your federal taxes, you will most likely use one of the following forms:

- Form 1040 (U.S. Individual Income Tax Return “long form”)

- Form 1040A (U.S. Individual Income Tax Return “short form”)

- Form 1040EZ (Income Tax Return for Single and Joint Filers With No Dependents)

- Form 1040NR (U.S. Nonresident Alien Income Tax Return)

- Form 1040NR-EZ (U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents)

If you’re feeling unsure about which form to use, you can visit irs.gov for helpful information. Many Americans also file electronically using online tax softwares like TurboTax. The software will walk you through the process. Another option is to hire a Certified Public Accountant (CPA) to help you file for the first time. They may be especially helpful if you have a tax obligation in multiple countries. Each country has a unique tax treaty with the USA.

If you choose to file on your own, you can also submit your tax form through either e-file or standard mail. Visit irs.gov for filing instructions and mailing addresses.

State income taxes are completely separate from federal taxes. Different organizations and programs in each state will tax different amounts. The amount of taxes you pay depends on which state you live and work. Be sure to talk to the human resources representative at your new place of employment for more information on how to file your state taxes.

When Do I File My Taxes?

The IRS generally begins accepting income tax returns in mid-January to early February. The federal income tax deadline is April 15th each year. It’s important that you file your taxes on time to avoid late payment penalties!

Each state has its own deadline for filing. Be sure to check this deadline with your employer's human resources representative.