Building Credit in the USA

August 17, 2021

Building credit is incredibly important in the United States. Your credit history and score will be used for a variety of important elements in your new life: assessing your application to rent an apartment, determining the terms of your car lease, and even contracting a mobile phone service.

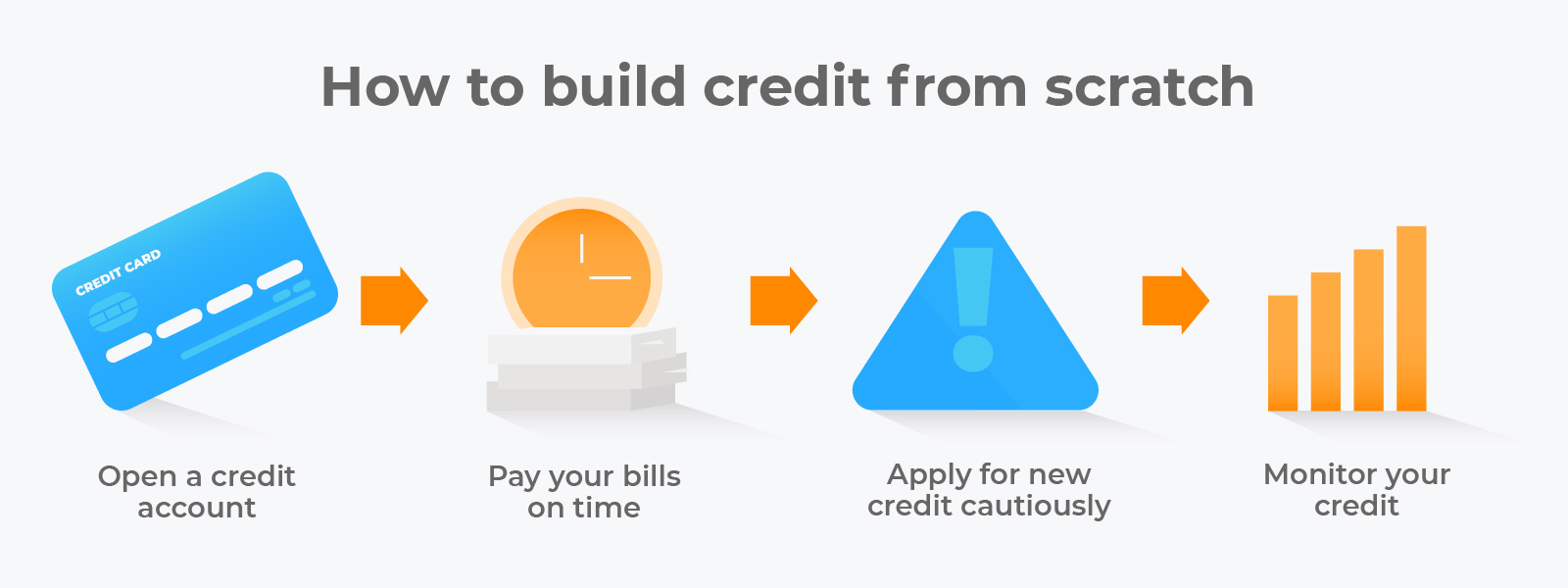

When you arrive in the US, you likely won’t have any credit history; even if your country has its own credit system, it is difficult if not impossible to transfer your full history to the US. This is why you will want to begin building your credit right away; the longer you have a credit history, the higher your score will climb. Luckily, there are a number of options open to a recent immigrant.

Start With A Credit Card

Credit cards are one of the best options for a recent immigrant to begin building credit. For one, they are relatively easy to apply for as long as you have a Social Security Number (SSN) or Tax Identification Number (TIN). Secondly, this is one of the only credit-building options that doesn’t have to cost you anything. As long as you pay off your balance each month, you won’t pay any interest!

Credit Card Tips

- See if you can transfer existing credit. If you already have a credit card in your home country, ask if they are able to issue a US credit card. American Express offers this option

- Try local credit unions first. Big banks like Wells Fargo will often reject applicants with no credit history. It’s better to try smaller local financial institutions first. Partners of our international nurse agency with Advancial Credit Union to help nurses get started with their first credit card. Bank of America also allows immigrants to open accounts and credit cards.

- Consider a secured credit card. If you’re having trouble being approved for a regular credit card, you can ask your local bank or credit unions if they offer a secured credit card. With this type of card, the bank will ask you to put a certain amount of money into an account, and they will then issue you a credit card with a limit of the same amount you deposited into the account.

- Apply in person. Online applications won’t give you any chance to explain why you have no credit history. Go into a physical branch instead so you can talk with someone about your situation and discover what they can offer you.

- Start with small purchases. You don’t need to spend a lot to build your credit. In fact, it can actually hurt your credit if your credit card balance is close to its credit limit. However, you do want to use it every month to continue building credit, so make small purchases each month for amounts you know you can pay at the end of your billing cycle.

- Set up automatic payments. Every time you make a payment on time, your credit gets a little boost (although it may take several months for this to reflect in a report). However, a late payment will do serious damage to your score, much more than an on-time payment helps. Always make your payments on time! Of course, it’s easy to forget your payment due date, so to make sure this doesn’t happen, set up automatic payments.

- Pay off your full balance each month. One of the factors that affects your score is the debt-to-credit ratio, or how much of the maximum limit you are using. The closer you are to your limit, the worse it looks to your lender. It’s best to pay your bill in full, signaling to your card issuer that you can be trusted with the loan and contributing to your positive credit history.

Get Credit For Your Rental Payments

Another credit-building opportunity that won’t cost you anything is reporting your on-time rental payments. Experian, one of the three credit-reporting agencies in the US, tracks rental payments through its RentBureau system. On-time payments are then factored into its calculation of your credit score. Ask your landlord if they report payments to RentBureau. If they don’t, look into a rental payment service such as RentTrack or Paylease that works with RentBureau. As an added benefit, you will be able to pay your rent electronically!

Network with Other Recent Immigrants in Your Area

Reach out to your community through social media and local networks to see what has worked for them. Your network can recommend banks, car dealerships, and rental agencies in your area that are friendly to immigrants with no credit history.